Roth 403b Contribution Limits 2025. So, if you want to max out your 401 (k) and roth. The ira contribution limits for 2025 are $7,000 for those under age 50, and $8,000 for those.

The maximum amount an employee can contribute to a 403 (b) retirement plan for 2025 is $23,000, up $500 from 2025. ‘2025 403b limits’ 11 items.

The maximum amount an employee can contribute to a 403 (b) retirement plan for 2025 is $23,000, up $500 from 2025.

_Withdrawal_Rules.png?width=5760&name=403(b)_Withdrawal_Rules.png)

Roth 403(b) Plan How It Works, Rules, Contributions, & Taxes, In 2025, the irs has forecasted an increase in the 401 (k) elective deferral limit to $24,000, up by $1,000 from the current limit. This contribution limit increases to $23,000 in 2025.

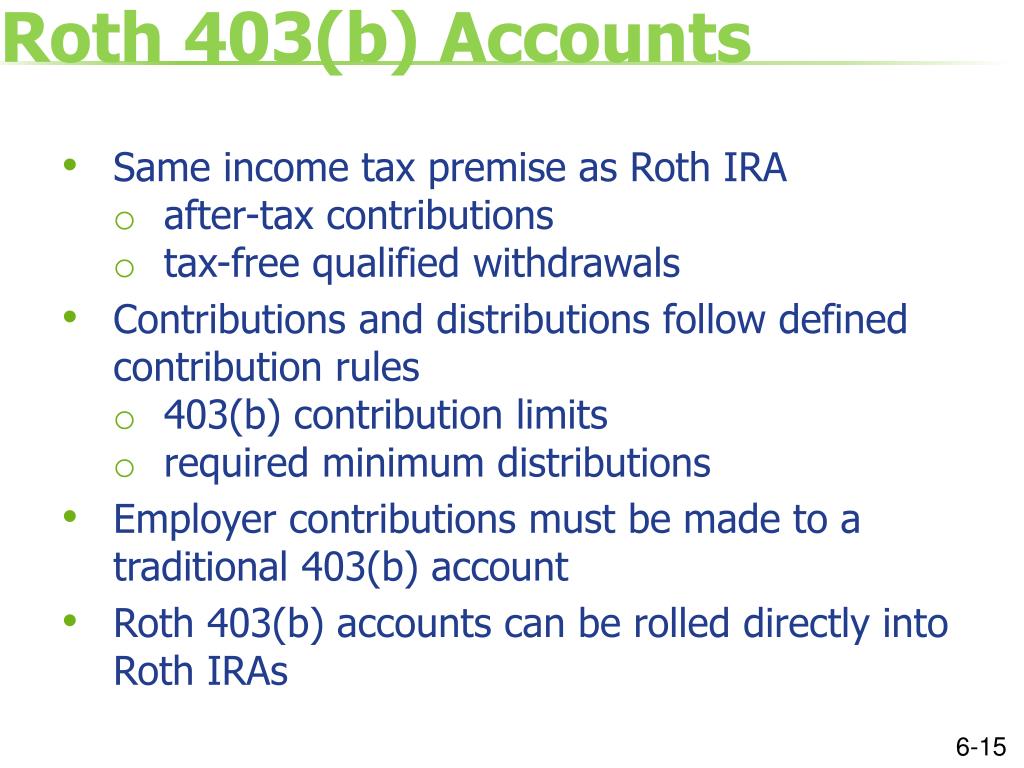

PPT Module 6 403(b) Plans & Other Plan Issues PowerPoint Presentation, This contribution limit increases to $23,000 in 2025. For 2025, employees could contribute up to $22,500 to a 403 (b) plan.

FAQ Roth 403(b), The total maximum allowable contribution to a defined contribution plan could rise $2,000, going from $69,000 in 2025 to $71,000 in 2025. More than this year, if one firm’s forecast is any indication.

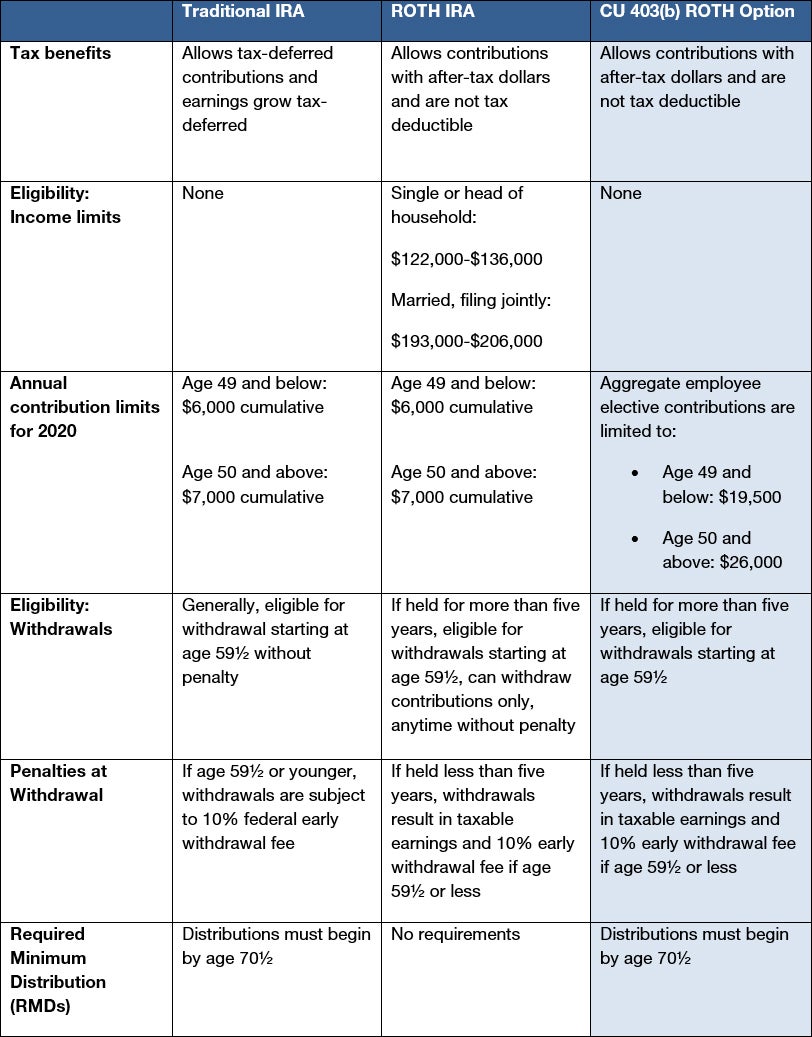

CU’s new 403(b) ROTH option enables aftertax savings for retirement, You can contribute up to $7,000 ($8,000 if age 50 and over) to roth ira in 2025. In 2025, the irs has forecasted an increase in the 401 (k) elective deferral limit to $24,000, up by $1,000 from the current limit.

Ira Roth Contribution Limits 2025 Min Laurel, In 2025, the irs has forecasted an increase in the 401 (k) elective deferral limit to $24,000, up by $1,000 from the current limit. Learn about the contribution limits for 403 (b) retirement plans in 2025.

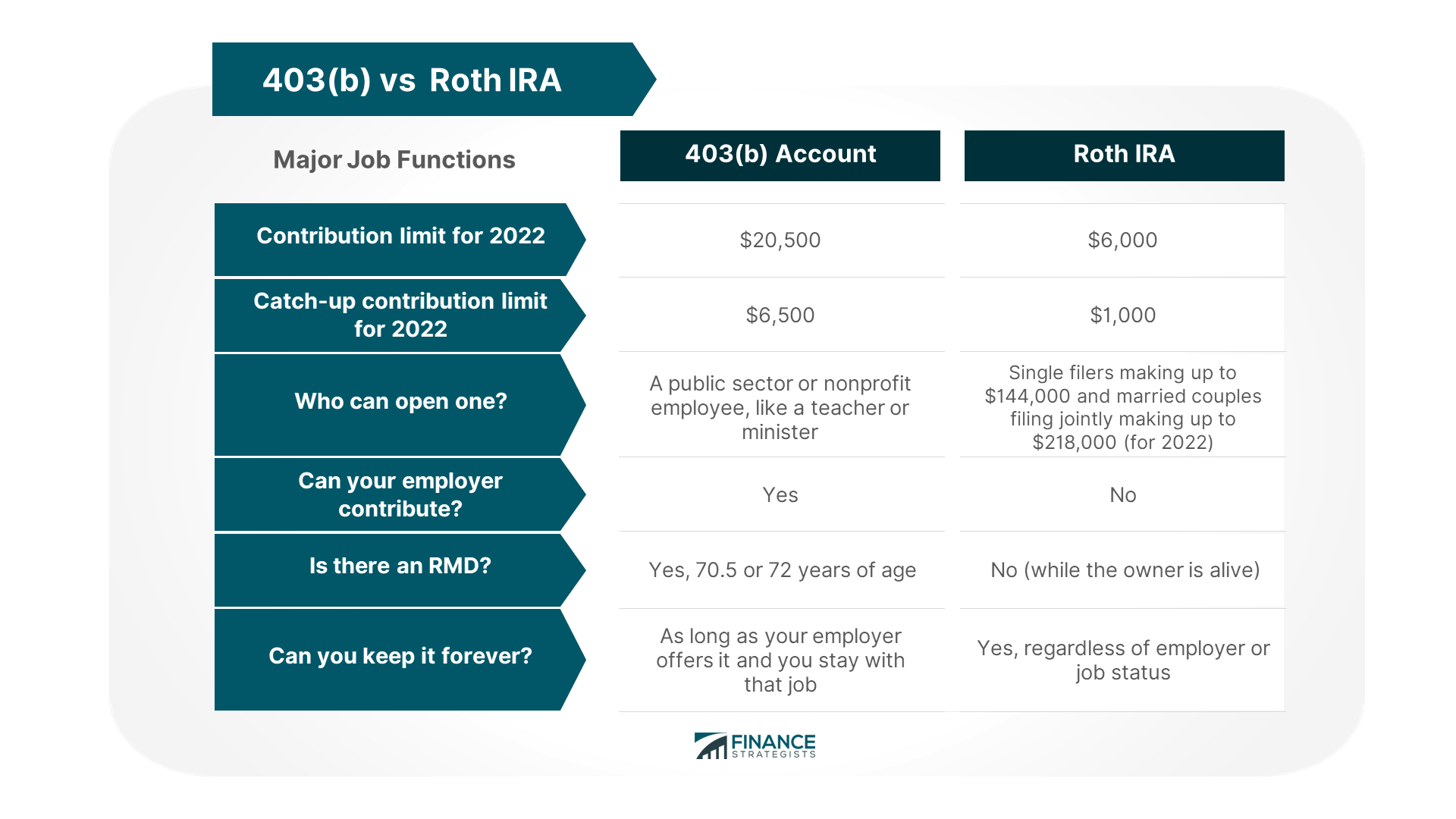

Is a Roth 403(b) Right for You? Rules, Benefits, Opportunities • InvestLuck, In the same year, you can contribute up to $23,000 ($30,500 if age 50 and over). A roth 403b and a roth ira are not the same account types.

Retirement Topics 403b Contribution Limits Internal Revenue Service, More than this year, if one firm’s forecast is any indication. How much will the maximum 401 (k), 403 (b), and 457 deferrals for defined contribution plans rise in 2025?

403(b) vs Roth IRA ¿Cuál es la diferencia? Estratega de Finanzas, The maximum amount an employee can contribute to a 403 (b) retirement plan for 2025 is $23,000, up $500 from 2025. The total maximum allowable contribution to a defined contribution plan could rise $2,000, going from $69,000 in 2025 to $71,000 in 2025.

Roth IRA contribution limits — Saving to Invest, The 2025 403 (b) contribution limit is $22,500 for pretax and roth employee. For 2025, employees could contribute up to $22,500 to a 403 (b) plan.

403(b) Or Roth 403(b) Which Is Better? What I've Learned As A, However, if you are at least 50 years old or older, you. Under the 2025 limits, the 403 (b) retirement plan maximum contribution, as an elective deferral, is $23,000.